how to pay late excise tax online

There is a non-refundable and non-prorated 80 flat fee associated with the issuance of the BusinessOccupation. The tax rate is 015 for Insurance Commission 05 for Wholesaling Manufacturing Producing Wholesale Services and Use Tax on Imports For Resale and 4 for all others.

Quick Reference Guide to Wine Excise Tax.

. Motor Vehicle Excise Tax MVET The Motor Vehicle Excise Tax applies to the sale of every motor vehicle that must be registered in the State of New Mexico. Taxpayers required to pay electronically will be subject to a penalty of 5 percent of the amount of payment made by check or cash. Federal excise taxes have been stable at 184 per gallon for gasoline and 244 per gallon for diesel fuel since 1993.

Penalty and Interest Calculator. Corporation Income Tax Return to correct Form 1120 or 1120-A as originally filed or as later adjusted by an amended return a claim for refund or an examination or to make certain elections after the prescribed deadline see Regulations sections 3019100-1 through -3. Prepare to pay extra if you owe taxes.

The penalty for filing late is 5 of the taxes you owe per month for the first five months up to 25 of your tax bill. USAgov provides a rundown on recent tax law changes including which tax breaks are being extended late changes in tax forms and instructions and changes in fees and deductions. Credit cards are only accepted as payment for current year individual income tax due on original Forms 500 500EZ 500ES corporate income tax due on original Forms 600 and 602ES and liabilities presented to taxpayers via Georgia Department of Revenue assessment notices.

Youll need to set up a Government Gateway account if you do not. To learn more about the differences between the GET and sales tax please see Tax Facts 37-1 General Excise Tax GET. Interest and late payment penalties will apply to any amount not paid.

Gwinnett has established 6 tax classes with rates ranging from 065 per thousand dollars of gross revenue to 130 per thousand dollars of gross revenue see item 10 on the application form. A18 Retailing Other Activities Return. When we accept payments in cash safety is our primary concern.

Taxpayers who file their tax return late will be subject to a late file penalty of 45 percent of the tax required to be shown on the return for each month or fraction of a month the return is late. The maximum late penalty is equal to 25 of the unpaid tax owed. The pay by phone option is only available to taxpayers who receive an invoice from the Department for outstanding excise tax.

Business Occupation Tax Certificate. This guide is intended to be a brief overview of the basic requirements for the proper computation and filing of wine excise tax. Every December some taxpayers rush to find ways to reduce their tax bills for the year.

The tax law is 26 USC. Call 1-800-2PAY-TAX 1-800-272-9829 ACI. Small Business Credit SBC Table Local sales tax rates Lodging information and rates.

A18 Business Occupation Activities Return. The complete text of all wine tax regulations may be found at 27 CFR 24270-279. The IRS will also charge you interest until you pay off the balance.

After two months 5 of the unpaid tax amount is assessed each month. Small Business Credit SBC Table Local sales tax rates Lodging information and rates. Motor vehicle owners and lessees are required by law to maintain continuous Georgia liability insurance coverage on vehicles with active registrations.

For more detail refer to alcohol excise terms. Additional penalties will apply if convicted of driving a vehicle with a suspended or cancelled registration. However most states exempt gasoline from general.

The tax is 4 of the price paid for the vehicle less any trade-in credit. This raised 374 billion in fiscal year 2015. These fuel taxes raised 90 of the Highway Trust FundThe average of state taxes on fuel was 3102 per gallon for gasoline and 3266 per gallon for diesel fuel in 2021.

You may pay by cash only if you received a waiver from the mandatory e-filee-pay requirements. If youre appealing against a 100 late filing penalty from tax year 2015 to 2016 onwards you can appeal online or by post. A18 Combined Excise Tax Return.

Use Form 1120-X Amended US. Penalty is 5 of the total unpaid tax due for the first two months. The IRS describes the impact of recent COVID-19 legislation on employment taxes.

Interest is calculated by multiplying the unpaid tax owed by the current interest rate. The law indexes the excise duty rates for alcohol twice a year based on the upward movement of the consumer price index. The tables on this page are a simplified version of the Schedule to the Excise Tariff Act 1921.

You can lose your refund. Driving a vehicle while the registration is suspended revoked or cancelled is a criminal offense. We presume that every time a vehicle is titled a sale has occurred and the motor vehicle excise tax is due.

We express excise duty rates per litre of alcohol LAL for alcoholic products.

A Guide To Your Annual Motor Vehicle Excise Tax Wwlp

Federal Excisetax Form2290 Quarterly Federal Excise Tax Form720 International Fueltax Agreement Report Ifta All These Tax Deadline Tax Filing Taxes

The Real Deadline For Depositing 401 K Deferrals And What To Do If You Re Late Www Patriotsoftware Com Payroll Software Deposit Employment

Excise Tax What It Is How It S Calculated

Home Seller Closing Costs In Massachusetts Closing Costs How To Plan Listing Presentation Real Estate

A List Of Some Of The Taxes We Pay Indirect Tax Capital Gains Tax Tax Services

Pin By Chris G On Vintage Electronics Vintage Electronics Low Tech Design

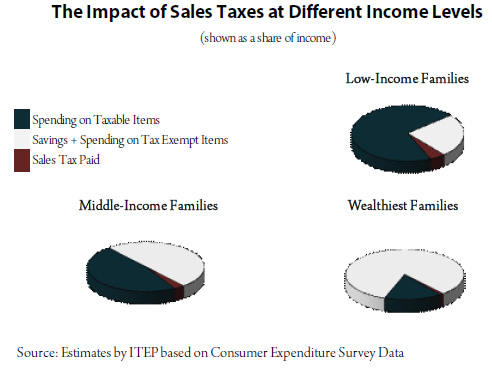

How Sales And Excise Taxes Work Itep

How To Calculate Cannabis Taxes At Your Dispensary

Changes In Income Tax Return Forms For The A Y 2015 16 Read Full Info Http Www Accounts4tutorials Com 2015 08 Key C Income Tax Return Income Tax Tax Return

I Robot U Tax Considering The Tax Policy Implications Of Automation Mcgill Law Journal